In order to help you advance your career, CFI has compiled many resources to assist you along the path. The preparation and presentation of this information can become quite complicated. In general, however, the following steps are followed to create a financial model. These three core statements are intricately linked to each other and this guide will explain how they all fit together. By following the steps below, you’ll be able to connect the three statements on your own.

What are financial statements?

By analyzing the cash flow statement, stakeholders can gain a comprehensive understanding of a company’s cash management practices and overall financial health. Financial statements are the ticket to the external evaluation of a company’s financial performance. The balance sheet reports a company’s financial health through its liquidity and solvency, while the income statement reports its profitability. A statement of cash flow ties these two together by tracking sources and uses of cash.

This might be retained revenue—money the company has earned to date—as in the example above. The statement of functional expenses reports expenses by entity function (often broken into administrative, program, or fundraising expenses). This information is distributed to the public to explain what proportion of company-wide expenditures are related directly to the nonprofit’s mission. This report tracks the changes in operation over time, including the reporting of donations, grants, event revenue, and expenses to make everything happen. Any residual balances after all assets have been liquidated and liabilities have been satisfied are called “net assets.” The CFS allows investors to understand how a company’s operations are running, where its money is coming from, and how money is being spent.

You need to prepare this first because it gives you the necessary information to generate the other financial statements. Making your income statement first lets you see your business’s net income and analyze your sales vs. debt. The three financial statements are (1) the income statement, (2) the balance sheet, and (3) the cash flow statement. Each of the financial statements provides important financial information for both internal and external stakeholders of a company. The last item in the order of financial statements is the cash flow statement, processed last because you use all of your financial data from the other three statements to create the cash flow statement.

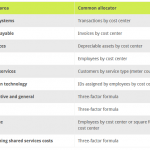

Summary Comparison of the Three Financial Statements

Your cash flow statement, or statement of cash flows, is all of your business’s incoming and outgoing cash. Basically, your cash flow statement shows you how much cash flows in and out of your business. This statement is particularly important for investors and shareholders as it provides insights into the company’s dividend policy and the percentage of earnings that are reinvested back into the business.

But total assets can also include things like equipment, furniture, land, buildings, notes receivable, and even intangible property such as patents and goodwill. For example, banks move a lot of money, so they prepare a balance sheet every day. On the other hand, a small Etsy shop might only get a balance sheet every three months. Below is a portion of ExxonMobil Corporation’s income statement for fiscal year 2023, reported as of Dec. 31, 2023. Expenses could be various operating costs, like inventory, rent, crucial accounting tips for small start-up business or utilities. Below is a break down of subject weightings in the FMVA® financial analyst program.

If your COGS and revenue numbers are close together, that means you’re not making very much money per sale. Equity can also consist of private or public stock, or else an initial investment from your company’s founders. Here’s an example of what a balance sheet looks like if you’re a Bench customer. Below is a portion of ExxonMobil Corporation’s (XOM) balance sheet for fiscal year 2023, reported as of Dec. 31, 2023. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path.

- After you gather information about the net profit or loss, you can see your total retained earnings and, if applicable, how much you will pay to investors.

- After you generate your final financial statement, use your statements to track your business’s financial health and make smart financial decisions.

- Nonprofit entities use a similar set of financial statements, though they have different names and communicate slightly different information.

- It provides insights into whether the company is generating profits or incurring losses, as well as the profitability of its core operations.

Which Financial Statement Is Prepared First?

This ensures that all companies are reporting their finances in the same way, which allows investors, lenders, and others to more easily understand their reports. External auditors also ensure that these financial statements are accurate with no misstatements or omissions, whether accidental or deliberate. As you know by now, the income statement breaks down all of your company’s revenues and expenses. You need your income statement first because it gives you the necessary information to generate other financial statements. The balance extraordinary items on income statement sheet presents the assets, liabilities, and equity of the entity as of the reporting date.

Below is a portion of ExxonMobil Corporation’s cash flow statement for fiscal year 2023, reported as of Dec. 31, 2023. Current assets are items of value that can convert into cash within one year (e.g., checking account). Noncurrent assets are items of value that take more than one year to convert into cash. Your cash flow might be positive, meaning that your business has more money coming in than going out. Or, your company could be in negative cash flow territory, which indicates that you’re spending more money than what you’re bringing in.

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. These three statements together show the assets and liabilities of a business, revenues, and costs, as well as its cash flows from operating, investing, and financing activities. It is important to note that the accounting for startup costs cash flow statement complements the income statement and balance sheet by enhancing the understanding of a company’s financial performance and overall financial position. Together, these three statements provide a comprehensive view of a company’s financial operations and help stakeholders make informed decisions. The primary goal of GAAP is to provide users of financial statements with reliable and relevant information about a company’s financial position, performance, cash flows, and changes in equity.